Facts About Not For Profit Organisation Revealed

Table of ContentsThe Best Guide To Non Profit OrgThe Buzz on 501c3 OrganizationThe Ultimate Guide To Not For Profit Organisation7 Simple Techniques For Not For Profit OrganisationThe smart Trick of Non Profit Org That Nobody is DiscussingNot For Profit Things To Know Before You Get ThisOur Google For Nonprofits StatementsNon Profit Organizations Near Me Things To Know Before You BuyNon Profit Organization Examples Fundamentals Explained

Incorporated vs - not for profit organisation. Unincorporated Nonprofits When people think about nonprofits, they generally believe of incorporated nonprofits like the American Red Cross, the American Civil Liberties Union Foundation, as well as other formally developed companies. Nevertheless, many individuals take part in unincorporated not-for-profit organizations without ever understanding they've done so. Unincorporated nonprofit associations are the outcome of 2 or more individuals teaming up for the purpose of providing a public advantage or service.Personal foundations might consist of family structures, private operating structures, and also company structures. As kept in mind over, they usually do not use any solutions and rather use the funds they increase to support other charitable organizations with service programs. Personal structures also often tend to need even more startup funds to develop the organization along with to cover legal fees and also various other continuous expenditures.

Getting The Npo Registration To Work

The assets stay in the trust fund while the grantor is alive and the grantor might handle the assets, such as acquiring as well as offering stocks or realty. All properties deposited into or bought by the trust fund stay in the trust with earnings distributed to the designated beneficiaries. These counts on can survive the grantor if they consist of a provision for recurring administration in the documents used to develop them.

The smart Trick of Google For Nonprofits That Nobody is Discussing

Conversely, you can employ a count on attorney to assist you create a charitable depend on and advise you on exactly how to manage it moving on. Political Organizations While the majority of various other kinds of nonprofit companies have a restricted capability to join or supporter for political task, political organizations run under various guidelines.

The Only Guide to Non Profit Organizations Near Me

As you evaluate your alternatives, make sure explanation to speak with a lawyer to figure out the ideal technique for your company as well as to guarantee its correct arrangement.

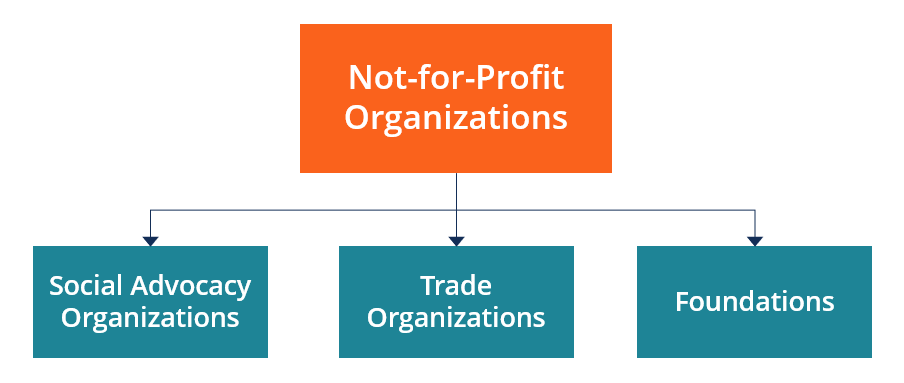

There are several kinds of not-for-profit companies. All properties and revenue from the not-for-profit are reinvested into the company or contributed.

Irs Nonprofit Search Fundamentals Explained

In the USA, there are around 63,000 501(c)( 6) organizations. Some instances of well-known 501(c)( 6) organizations are the American Farm Bureau, the National Writers Union, and also the International Organization of Satisfying Organizers. 501(c)( 7) - Social or Recreational Club 501(c)( 7) organizations are social or entertainment clubs. The function of these nonprofit companies is to organize activities that cause satisfaction, entertainment, and socialization.

Getting My 501c3 To Work

501(c)( 14) - State Chartered Credit Scores Union as well as Mutual Reserve Fund 501(c)( 14) are state legal credit score unions as well as mutual book funds. These companies supply monetary services to their participants and the community, normally at affordable prices.

In order to be nonprofit partnership qualified, at the very least 75 percent of participants have to exist or previous members of the USA Armed Forces. Financing comes from contributions as well as federal government grants. 501(c)( 26) - State Sponsored Organizations Providing Health And Wellness Protection for High-Risk People 501(c)( 26) are not-for-profit organizations created at the state level to offer insurance policy for high-risk people that may not be able to obtain insurance coverage via other means.

Some Known Details About Not For Profit

Financing comes from donations or federal government gives. Examples of states with these risky insurance coverage swimming pools are North Carolina, Louisiana, as well as Indiana. 501(c)( 27) - State Sponsored Workers' Payment Reinsurance Company 501(c)( 27) nonprofit organizations are created to give insurance for employees' compensation programs. Organizations that give workers compensations are needed to be a participant of these organizations and pay charges.

A nonprofit corporation is additional hints an organization whose function is something various other than making a revenue. 5 million not-for-profit companies registered in the United States.

How Nonprofits Near Me can Save You Time, Stress, and Money.

No person individual or group has a nonprofit. Properties from a not-for-profit can be marketed, but it benefits the entire organization instead than individuals. While any individual can incorporate as a nonprofit, just those who pass the strict criteria set forth by the federal government can attain tax excluded, or 501c3, condition.

We talk about the actions to becoming a nonprofit additional right into this page.

501c3 Nonprofit Fundamentals Explained

One of the most vital of these is the capability to get tax "excluded" standing with the IRS, which enables it to get donations devoid of gift tax obligation, permits contributors to subtract contributions on their tax return and exempts a few of the company's activities from income taxes. Tax excluded condition is essential to lots of nonprofits as it encourages contributions that can be used to support the mission of the organization.